About Us

Qantara Private Capital

We are an ethics-first fund, committed to stewardship that helps our clients generate and protect generational wealth.

Qantara Private Capital is a values-driven private equity firm committed to long-term impact. We invest with purpose, discipline, and integrity.

We believe in ethical investing, value creation through partnerships, and responsible stewardship.

Rationale for establishing Qantara Private Equity Fund that’s also Shari’ah compliant

In response to market feedback from our clients and general market sentiment, as well as planning for our growth across the region, Qantara has responded to the burgeoning international and local demand for high-quality investment products that are Shari’ah compliant, with its own well considered, ethically raised, managed and deployed, private capital offering, open to both local and international investors.

Qantara Private Capital houses three private capital funds (“the Funds”), each structured as an en commandite partnership. Numeral Financial Services, which manages these Funds is fully owned by Numeral Limited, a holding company in-ward listed on the Johannesburg Stock Exchange, with its primary listing on the Stock Exchange of Mauritius. These Funds are intended to be inclusive in both nature and application and are open to any investor who identifies with the investment philosophy and true portfolio diversification, seeking shielding of their wealth from traditional western finance interest bearing structures.

They are designed to cater to the needs of the discerning investing community that seek ethical, cash flow generative and legacy defining investment opportunities, as well as to investors looking for greater high-quality diversification in their capital allocation decisions.

Qantara’s offering includes three distinct funds: an Income Fund, a Growth Fund, and a Property Fund. This structure offers unique opportunities for risk mitigated growth and competitive returns whilst adhering to the most prudent ethical investment principles.

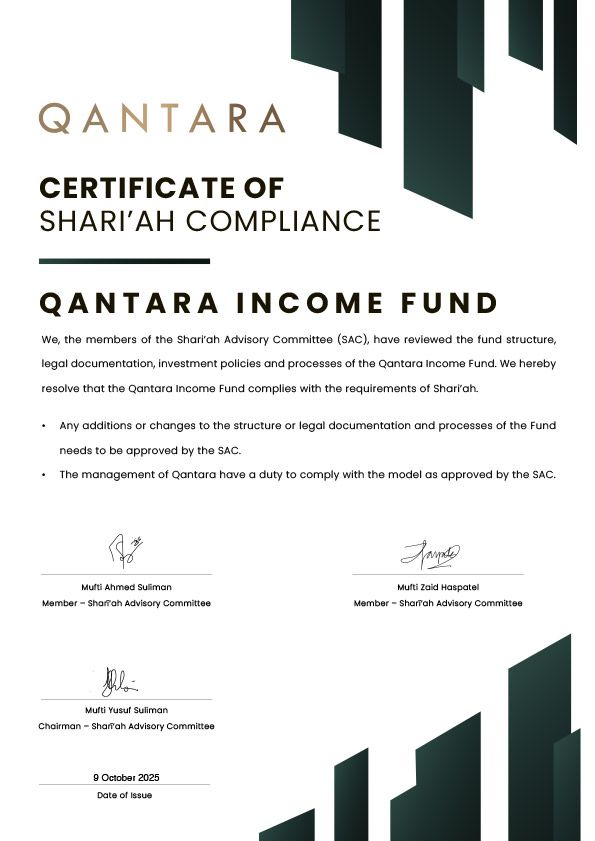

Shari’ah Advisory Committee

A Shari’ah Advisory Committee has been appointed to provide oversight, to ensure we adhere to and maintain the required faith based and ethical requirements. This committee will provide their expertise on all levels of compliance, as well as guidance on pursuing investments for the respective funds. Members of the committee include:

Muftī Ahmed Suliman

Muftī Ahmed is a Sharī’ah scholar of high repute in the Islāmic Banking, Investments and Insurance space. He has served as a Sharī’ah Advisor and Board Member for numerous financial institutions for over two decades, both locally and internationally. He completed the BA/MA Ālim course (Higher Islāmic Studies) and thereafter attended the Iftā course (Islāmic Jurisprudence and issuance of Fatāwā [Islāmic verdicts]), at Darul Uloom Zakariyya.

He served as a Muftī for the Jamiatul Ulama KZN (Council for Muslim theologians) for three years, looking after the Fatwā and Judicial Departments, and was also a member of the Mediation and Arbitration committee. Additionally, on behalf of Jamiatul Ulama KZN, Muftī Ahmed served on the Board of Muftis of South Africa.

Muftī Zaid Haspatel

Muftī Zaid Haspatel is an accomplished Islāmic scholar who completed his BA/MA Āalim course with distinction, followed by the Iftā course, specializing in Islāmic jurisprudence and the issuance of Fatāwā (Islāmic verdicts), at Darul Uloom Zakariyya. He also earned a master’s degree in Islāmic Studies, cum laude, from the University of South Africa.

Since his graduation, he has been a lecturer at Darul Uloom Zakariyya and actively participates in the field of Iftā, with a particular emphasis on Islāmic finance. His expertise has led him to serve as a Sharī’ah Advisor for various prominent Islamic Financial Institutions.

Muftī Yusuf Suliman

Muftī Yusuf, a credible and esteemed scholar, completed his BA/MA in Āalim and Iftā (issuance of verdicts) from Darul Uloom Zakariyya, Lenasia (South Africa). He is accredited by the Accounting and Auditing Organization for Islāmic Financial Institutions (AAOIFI) as a Sharī’ah Advisor and Auditor. Additionally, he holds a Certificate in Qadhā (adjudication) from Imarat Shari’ah, Patna Bihar, India. Having been contracted by BANKSETA, Muftī Yusuf developed the Islāmic banking training material for all South African Islāmic Banks. Muftī Yusuf serves on the boards of various Islāmic Banks, Asset Managers and Takāful companies.